Resources

Contemporary Dialysis & Nephrology • March 2000

Reimbursement: The Fuel for High-Quality Dialysis Care

John A. Sargent, Ph.D.

Even for a small single facility provider, dialysis is a business that provides a valuable service to hundreds of thousands of patients across the U.S. It’s also a business that has very low margins. Modem businesses use computer technology to improve its operations. Computers have potential for the dialysis enterprise as well. Computerization, however, is not an overarching solution for all of the challenges in this field. Computers are tools. The user should select the one that is most suitable for the job. This means defining a specific problem where better and more rapid use of data and information can be of benefit.1

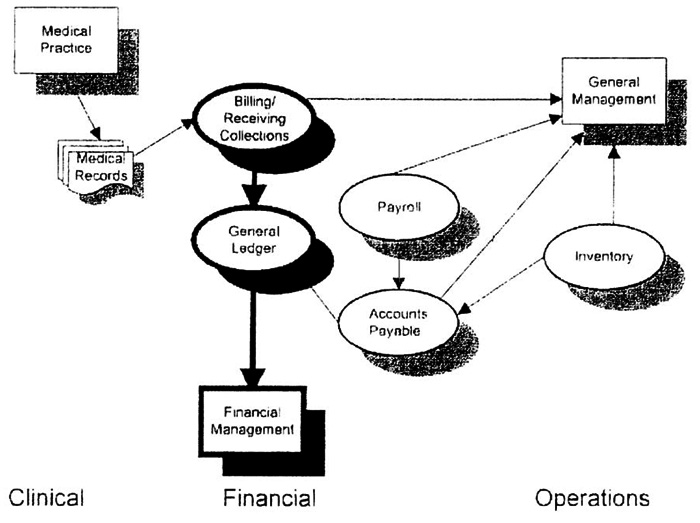

To help evaluate the use of information, divide dialysis business systems into the following primary areas (see Figure 1):

- Clinical—to assure delivering optimal treatment, identifying medical problems as early as possible, and effectively meeting the medical needs of individual patients.

- Operational—to understand the fundamental elements of the business, and the dynamic challenges that need to be dealt with for continued success; and,

- Financial—to ensure the billing and collection of appropriate revenue, control of costs, and overall business health of the enterprise.

Figure 1: Illustrates automation in a dialysis facility, showing computerized needs in the areas of clinical, financial, and operational management.

Clinical Information Systems

Anything we, as an industry, can do to provide better treatment for the dialysis patient is a high priority. In the past, there were concerns that patients in the U.S. were not receiving high quality treatment, and several conferences promoted this theme.2,3 The National Kidney Foundation-Dialysis Outcomes Quality Initiative Project4 took this as its mandate, and provided an excellent set of clinical practices to help dialysis providers improve patient care, and reduce the unacceptably high morbidity and mortality rates.

Clinical information systems can assist in these efforts by alerting caregivers to problems and tracking critical areas of patient care. The techniques for treatment improvement are still evolving, and in many cases, are not routine enough for computers to accomplish more than document and report various phases of treatment.

However, clinical systems also have a business function. It passes details of the treatment on to the business group to assure complete reimbursement for delivered care.

Operational Information Systems

It is important to ensure that an operation is running efficiently. Some examples of operational information are:

- The use of medications and the cost to provide them;

- How the dialysis unit census may be trending or varying throughout the year, and what associated staffing is needed; and,

- The areas where patients are located, where additional patients are likely to come from, and where increased capacity and facility development is desirable.

Financial Systems

Financial systems are the core of a business. It ensures that the business has a strong financial base, and aids in anticipating and meeting resource needs. Figure 1 shows that several software tools comprise the “financial systems.” A feature of these systems is that in contrast to clinical and operational systems, it assists in clearly understanding the rules for financial software and performed tasks—a key attribute for acquiring effective computer systems.1

Financial systems are commonly included in an “accounting package,” which can be separated into the general ledger, accounts payable (AP), and accounts receivable (AR). While some providers may address clinical and operational system needs with primarily manual methods, virtually no one would attempt by hand to do the extensive accounting functions represented by the general ledger.

This is not necessarily true for AP in a field where there are a small number of vendors, although automation of this function makes it easier as well. Billing and receivables in dialysis, in sharp contrast to a general business, present a degree of complexity that makes manual methods tedious, time consuming, and costly. The reimbursement problem in dialysis lends itself to software specifically targeted to this purpose.

From Figure 1, linking some of these areas becomes clear. For example, if the AR system retains key data, this database can be the source for operational functions. This is not always a characteristic of commonly used reimbursement systems.

Reimbursement Systems Impact

Monies received for all reimbursable aspects of dialysis services are critical to the on-going health of the enterprise. There are details of this reimbursement process that, while they may seem arcane, will have a major impact on the expense of being paid. It also is as much a cost to the enterprise as the cost of dialysate or erythropoietin. These details are “cash flow.”5

Days Service Outstanding

The cost of not being paid promptly is calculated by Days Service Outstanding (DSO), the unpaid number of days of services rendered (i.e., outstanding). For example, on a weekly basis, if you earned $24 per hour, at the end of a 40-hour week your employer would owe you $960. At the end of the week (before being paid), you would have a personal DSO of five days. If your employer decided to pay on a four-week cycle, the DSO would be 20 days just before payday. The extra 15 days (or $2,880) is worth what you could do with that money. If you had a credit card debt (at a common 18% interest rate), this would effectively cost you $518.40 per year.

Some dialysis providers say: “I bill $450,000 per month, and I collect the same amount. Where’s the problem?”5 If they have slow billing methods and an inefficient collection process, however, they may be months behind and have a DSO of 120 (i.e., equivalent to four months of services) and AR of $1.8 million (for a 150-patient facility).

In the dialysis field, where monthly billing is the norm, it is difficult to get a DSO below 40-50 (at the end of each month, DSO are, by definition, 30, even before the bills are produced). An effective AR group commonly will have a DSO of 50 to 60 days.

Therefore, for the facility with a DSO of 120 days, there are 60 days of services ($900,000) that could have been collected and are costing the provider approximately $90,000 per year (assumes a debt service rate of 10% annually). Anyone who observes his bank balance lowering each month after the deduction of interest on a loan understands this is a real expense.

One of the key parameters to measure reimbursement problems—including slow collections, inefficient use of staff, and probable abandoned charges—is the level of the DSO.

AR Staff Effort

It takes staff to bill and collect for dialysis services. In theory, the more automated a provider, the fewer staff is required. While this is generally true, if the tools are well suited to the job, not all of the billing and collection process lends itself to automation.

The appropriate function of computers in this task is to automate routine activities. This will assure a clean bill with all the appropriate codes, prices, etc. AR then correctly tracks amounts actually owed, and when money is collected, it matches received amounts.

Automating these complexities will free up staff to address tasks that require their special skills. These include following up on denied charges, addressing issues with Medicaid payers, assuring that treatment authorizations are up to date, and supplying information to management for operational decisions.

While the number of patients that an AR group can handle depends on the size of the provider and the organization of the business, a rough range is 120 to 170 patients/fulltime equivalent (FTE). It follows that a lower ratio adds to the overall cost of the reimbursement process.

Not apparent in the above numbers are required tasks. If the group with 170 patients is simply using ineffective processes to generate bills, it may not be able to handle other tasks, such as collections, and may be paying for their apparent “efficiencies” with higher DSO and abandonment of charges (see below).

Lost or Abandoned Charges

It is difficult, if not impossible, to analyze lost charges (i.e., items that never get into the reimbursement process and onto the bill). There are charges denied, or those for which there is no justification. Subsequently, it may not be “worth the effort” to pursue these items. The perceived cost associated with the effort is the basis for the judgment. Strongly influencing such a judgment can be lack of automation if the difficulties of making corrections to a claim (e.g., correcting a justification) or resubmitting a claim to another payer (as in the case of systems that do not retain treatment details after bill production) prove to be labor intensive.

Although an analysis of abandoned charges is difficult, a clue to their existence is the presence of a high DSO, which also has implications regarding the effectiveness of the reimbursement systems. With poor systems, the manual effort to reproduce a claim may be greater than the yield. In addition, in an enterprise with a high DSO, there is commonly a high degree of stress and an effort to get rid of “minor” frustrations in order to deal with the major claims load (i.e., the tendency to write off smaller amounts).

“Small” amounts may be of the same order as normal margins in a dialysis enterprise, however, and the value of these items—which have, in fact, been part of the treatment and expenses for the facility—directly affect the “bottom line.” That is, if $3 per treatment is a write off (a not unusual occurrence), there is $3 less profit for the provider.

Compound Effects

Inefficient methods—both organizational and due to ill-suited software—can cause all of the above problems. For example, if it is difficult to perform the normal tasks, such as automatic claim generation, posting cash and billing secondary carriers, rebilling when the wrong payer was initially billed, etc., then the following is not an unusual scenario:

- Delay in claim production and transmission with attendant increase in the DSO;

- Delay in taking remedial action if a claim is denied, and difficulty in correcting specific items because the details are old and no longer in the patient’s chart (data may have to be re-entered to produce a new claim); and,

- There is a tendency to write off small amounts to avoid re-doing a denied claim.

Reimbursement Problems

Reimbursement problems can seriously affect the health of any dialysis provider. Dialysis staff often considers the DSO and back office staffing, and abandon charges as arcane and not central to providing high quality care. However, reimbursement is the fundamental fuel that makes quality care possible, and problems with it can cause disruption to even large highly regarded dialysis providers.

“The key to the dialysis industry is not just providing the dialysis service, but billing for this service,” according to industry analyst Andreas Dirnagl of Gerard Klauer Mattison. “If billing falls behind, and the company is unable to pull the information (from its systems) needed for reimbursements, there is a problem that hurts revenue.”6

Smaller providers might take the position that these are problems faced by larger providers with greater revenues and have nothing to do with them. It is important, however, to realize that problems of a proportional nature can plague the small provider. The numbers will not be as large, but the problem can be just as severe.

Impact of the Software Solution

Today, when there are a great number of inexpensive financial packages, it is tempting to assume that simple or generic financial software will fit the dialysis application. This is particularly true for physicians who have office packages the vendor may claim can be easily adapted for dialysis. It is also very common in hospital settings, where there is heavy pressure for all departments to use the main hospital financial software.

In both cases, such a choice would reflect limited understanding of the special software capabilities needed for this application.

Work Arounds

If the software selected does not meet the specific needs for dialysis, it may still perform well enough for the provider to be paid, but with many “work arounds” needed. Many hospitals periodically discharge and re-admit patients in order to conform to the software requirements. In other cases, once a bill is generated (or soon thereafter), treatment detail is erased. All charges must then be re-entered for a re-billing, if needed. Other systems require a daily “close” as part of normal operations, a common feature of a physician’s practice.

Systems designed strictly for billing lack sufficient detail to address operational challenges. As shown in Figure 1, an effective automation plan will address many aspects of the dialysis enterprise. A fundamental premise for effective automation is that data, once entered, need not be entered again. With reimbursement systems, it is highly desirable for information contained in the database to be in a form that can answer operational questions. With systems designed strictly for generic billing, these data are often not available, and this dramatically reduces the value of the system to the overall enterprise. Implementation Difficulties

Although dialysis providers may recognize many of the problems and limitations described above, they may be viewed as too difficult for change. Furthermore, these systems often have become a fundamental part of the enterprise, and staff becomes used to familiar and deficient reports. Replacing a system that appears to be working may seem a hard-to-justify expense.

Analysis of the cost elements of dialysis reimbursement—including the DSO, FTEs, and abandoned charges—may give a better perspective to the cost of retaining a system that was a “force fit” to begin with. If one considers the inefficient 150-patient enterprise, used as the above example (with a $450,000 monthly revenue), what could be the possible effect of inappropriate reimbursement software? It includes:

- A DSO of 120 days: a change to 60 days will liberate $900,000, an annual savings of $90,000.

- FTEs of 1.0 for each 100 patients: an improvement to 1.0 for 150 patients will save 0.5 FTE or $17,500 (probably by reassignment of staff).

- Abandoned charges of $3.00 per treatment: the elimination of this will yield $64,800.

All these savings can be realized by using better reimbursement software. The total annual savings and increased revenue would be $172,300, or more than 3% of annual revenue (approximately $8 per treatment). This amount becomes net income (i.e., the “bottom line”) and will be a significant part of normal dialysis provider margins. Even though it may require some temporary extra effort, implementation of a more effective software solution will generally more than pay for itself in the first year.

Software Selection

The best time to arrange for computerization is in the planning stages of a dialysis enterprise. If possible, all the elements of Figure 1 should be determined at this time to avoid installing inappropriate systems. Being able to prospectively select all of the elements in this figure with confidence, however, is considerably more difficult than it might seem.

Not all parts of an overall computer solution are well defined. It’s more difficult to establish a fundamental definition of the clinical/medical record system requirements than is the case with financial systems. An omnibus computer system can be unwieldy and complex, and will often fail to properly address the needs of the dialysis facility (see computer system analysis by the Dialysis Outcomes Practice Patterns Study in Reference 1). There also tends to be the setting of unrealistic goals, such as the anticipated benefits of a “paperless” system.

A wise choice is to plan for the total system computer needs, choose the elements as they become defined, and then implement them incrementally. In this way, the installation of financial systems would come first because of the need for cash and for building a sound financial base. Follow with other systems as needs are defined, and the funds become available.

Open Systems

When selecting the incremental approach, the systems chosen must be able to work together. This can be a problem if any of the systems are proprietary in nature (i.e., with their own structure and homemade database). Avoid this problem with the “open system” method.

Such systems utilize powerful commercial databases, such as Oracle, Sybase, Ingres, etc. Most modern open systems also incorporate HL-7 protocols (Health Level Seven, a data transfer protocol for the medical field), so it can transfer data between programs and form effectively integrated systems.

Conclusion

Reimbursement is one of the most important operations of a dialysis provider. It requires talented and committed staffs, and well-designed software to deal with the arcane nature of dialysis reimbursement. Good staff alone can have a significant impact, but good software systems can permit these individuals to effectively manage a process that can easily get out of control. If it does get out of control, it can increase the cost by amounts that are of the same magnitude as margins.

A further benefit of systems that retain complete data is that staff freed from the tedium of manual entry and work-arounds can perform valuable operational analyses. Such analyses can help the dialysis provider understand trends, challenges, and opportunities for the ongoing health of the organization.

About the Author

John A. Sargent, Ph.D., a 33-year veteran of the dialysis field, began his career with the development of hollow fiber dialyzer at Dow Chemical; he then went on to develop mathematical models for dialysis therapy. The latter effort culminated in urea kinetic modeling and the National Cooperative Study, of which he was co-principal investigator. For the past two decades, Dr. Sargent, president of QMS, has concentrated on the business aspects of dialysis, and the best methods far satisfying the financial and operational needs of a dialysis operation.

References

- 1. Sargent J.A. Gathering data in the dialysis unit: What do you need? Why do you need it? Nephrology News & Issues 1999; 13(9): 19.

- 2. Parker T. The Dallas morbidity and mortality conference. American Journal of Kidney Diseases 1990; 15.

- 3. Strategies for influencing outcomes in pre-ESRD and ESRD patients: A special conference. American Journal of Kidney Diseases 1998; 32(6) (Suppl 4).

- 4. NKF-DOQI Clinical Practice Guidelines. American Journal of Kidney Diseases 1997; 30(Suppl 3).

- 5. Sargent, J.A., Grutze, A., and Ontiveros, C. Cash flow and accounts receivable management for dialysis. Dialysis and Transplantation 1984; 13(4): 201.

- 6. Mantz, B.M. Dow Jones Newswires, October 5, 1999.